.png)

With all the ‘excitement’ occurring across the Americas, on the other side of the world, events have been slipping under the radar.

Over the past 18 months, there have been a lot of political changes within the Japanese government. Multiple elections and leadership changes have occurred, which may well have at least partly contributed to the yield widening1 observed on Japanese Government Bonds (known as JGBs).

A timeline of events

On 27 October 2024, Japan held elections for its Lower House (which is equivalent to a General Election in the UK). This initiated a timeline of events (shown in Fig. 1) leading to the current situation, where a new election is expected within weeks.

When the election was called in 2024, Japanese 10-year yields were around 1%. However, amid the political turmoil over the last few months, yields have widened daily and dramatically2 (by historical Japanese standards), with the 10-year now well over 2%.

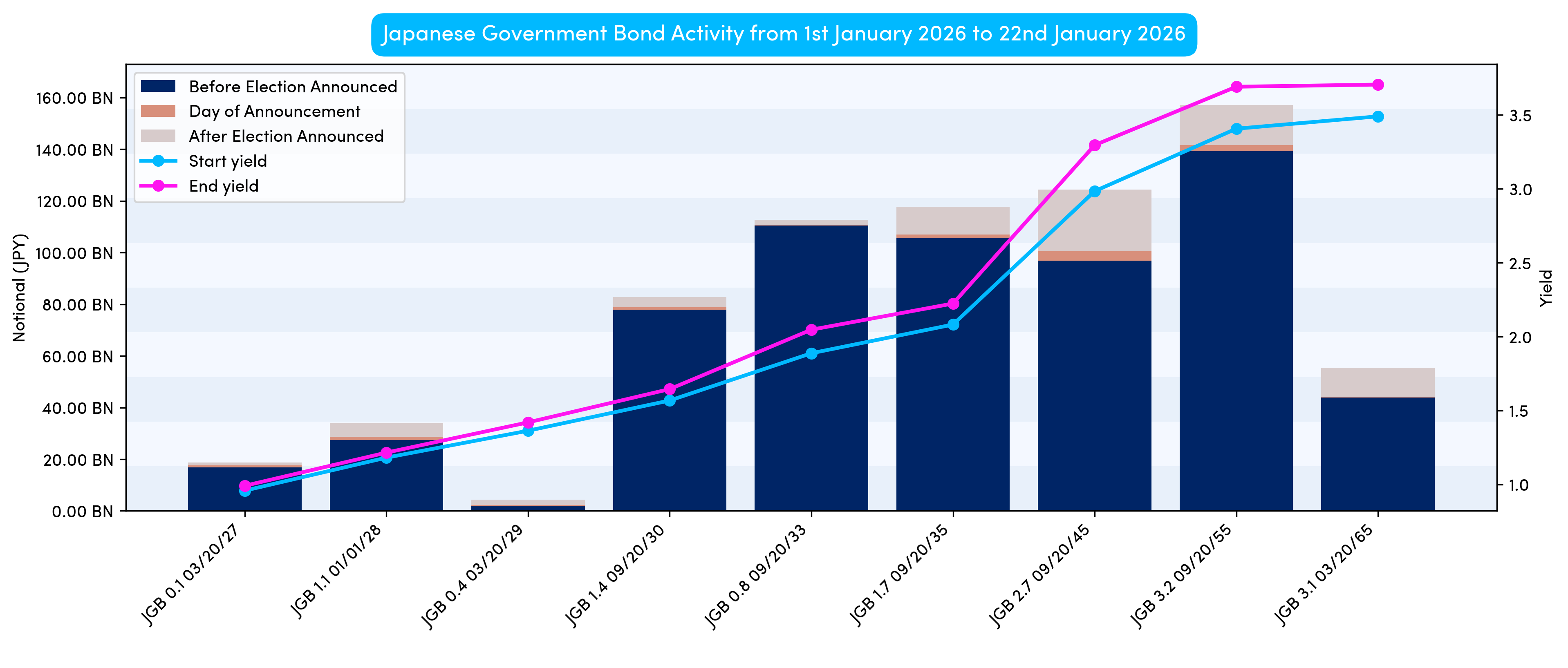

Chart 1 shows a breakdown in volumes, based on some of the key events above, along with the starting and ending JGB yield curves.

.png)

Chart 1 presents the change in yields and reported volumes from October 2024 through to January 2026. Each JGB is assigned to a tenor bucket from 1 to 40 years, after which the volume for each bucket is calculated and the yield overlaid. It is apparent that volumes are roughly proportional to the time period (i.e. it is not obvious that any particular political event led to a dramatic increase in volumes). However, yields have widened dramatically across the curve, in excess of 100 basis points in some cases.

Chart 2 below provides a more granular view, not only focusing on recent activity but also highlighting the most active JGBs for each tenor bucket.

By drilling down to see issue-specific volumes, we can see that activity since the recent election announcement has been proportionally higher at the long end. Additionally, yields have continued to widen, with this being more pronounced at the long end of the curve.

Whilst not all JGB activity is reported under MiFID, the available data still provides useful insights and highlights key trends.

1https://www.japantimes.co.jp/business/2026/01/20/economy/bond-yield-hit/